Latest Articles

A STUDY OF CERTAIN DEDUCTIONS ON INCOME TAX RELATING TO FOREIGN TRADE

ABSTRACT:

This doctrinal paper shall cover certain deductions and concessions to income tax under Section 10 of the Income Tax Act 1961. These are primarily aimed at one goal; boosting foreign trade relations as befits the liberalized policy of India since 1991. The specific legal rules governing these deductions shall be brought out through provisions and case laws. This is done because the author is personally against taxation and wishes to develop an understanding on what some of the situations are for having one’s income tax be legally avoided or reduced. In specific, the author wishes to consider possible lenience mechanisms in taxation of wealthy and affluent persons and enterprises. This understanding would be significant to the appropriate fields of professions covered, viz foreign nationals trading on Indian soil in designated areas.

CHAPTERIZATION:

- Deductions for the National Economy:

This chapter shall cover deductions allowed for free trade zones and special economic zones. It shall attempt to discover the rationale behind these provisions.

- Concluding Opinions:

By collating the understandings of the above chapter with respect to the rationale behind such laws, the author submits his understanding of the situation, the justifications for the same and alternative suggestions.

- DEDUCTIONS FOR THE NATIONAL ECONOMY

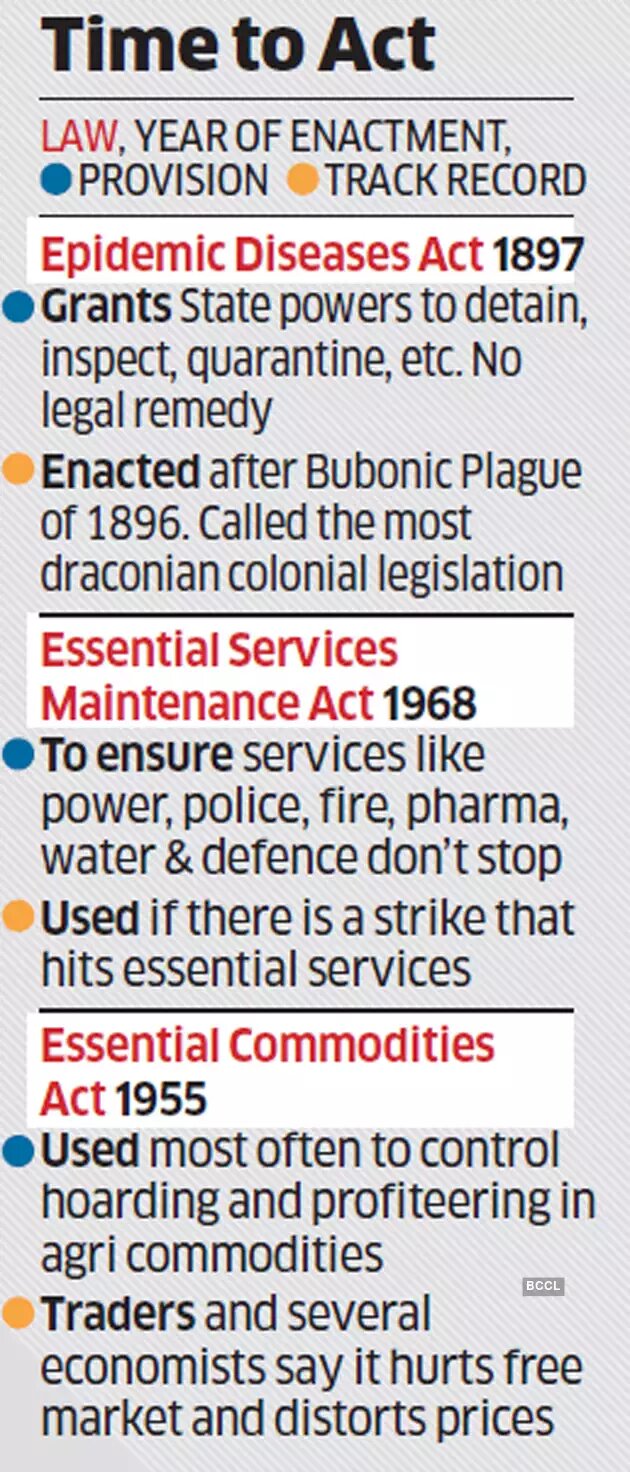

This chapter covers deductions instituted to promote Free Trade Zones[1] and Special Economic Zones[2]. While studying these deductions the role of Special Economic Zones in the Indian economy must be considered to understand the rationale. Special Economic Zones are expected to promote foreign trade, specifically exports, and also must be in sync with the sovereign integrity of the nation, by considering its international relations[3]. These are criteria for approval by the central government and the appropriate board. Thus, as can be seen from the upcoming segments too, it is the foreign investments and foreign exchange earnings that the Union considers tantalizing and worthy of perks such as deduction.

- LAW APPLICABLE TO INDUSTRIES ESTABLISHED PRIOR TO 2005

Special provisions in respect of newly established undertakings in free trade zones are as follows[4].

The conditions required under this satisfaction to be eligible for deduction as under section 10A are as follows:

It commenced manufacture or production of articles, things and/or software in designated free trade zones, at any time from 1981 onwards until 1994, in designated electronic hardware technology or software technology parks from 1994 to 2001, or in a designated Special Economic Zone from 2001 to 2005 March 31st.

These electronic hardware technology parks and software technology parks are notified under a scheme by the Central ministry of commerce and industry. These computer softwares however have to be exported out of India (by any means)[5].

At this point it must be noted that manufacture is only a subset of the larger concept of production[6].

An important feature of tax law to be noted here is that these deductions do not cease to apply if production of these softwares is done at the client’s site, or sur place, as long as the employees of the center of production notified in India have done the production[7].

Further, this deduction does not end at the production of software. Rather, the other processes which are important to carry on this foreign trade also require protection, if the legislative purpose of promoting liberalized economy is to be safeguarded. Thus, even post production, processes like maintenance of the software also have this deduction of tax on the income earned, under S.10A. This is because such maintenance is an inherent part of software development itself[8].

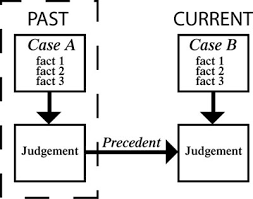

However, while this is the ratio, and by extension the law in force, which came to be in the Direction Software Solutions[9] case, the specific nature of the factual matrix must be understood to see the manner in which this precedent can be used in the future.

For one, this was an appeal by software maintainers after a failed appeal to the Commissioner of Income Tax (Appellate). Besides, in the case at hand, while the business for which deduction was sought was under the category of maintenance, the specific nature of that enterprise entailed modifications to optimize the workings of the software before exporting the same, as well. Further, the maintenance job itself was pivotal to be permanently active in that the employees had to troubleshoot and service the software that would inevitably run into glitches, errors and bugs while being used by consumers abroad. Thus these maintenance costs themselves were also largely a part and parcel of the product sold.

On a broad level, it was the basic understanding of the judiciary that in this case, the processes dubbed as ‘maintenance’ were essential to the development of the software. At any rate, the IT(A)T held that software maintenance was the ‘last step’ in the development of software, unlike maintenance in the regular connotation, thereby quite clearly bringing the process of maintenance under the blanket of manufacturing[10]. It was also iterated that software as a product itself is never finite or complete but a dynamic updating product[11].

It is interesting to note herein that customization of the software is also considered as part of development of the software[12]. Customization is about the designing of the user interface and is in a way the opposite of the maintenance aspect of software. Maintenance is not part of the core commodity but it is essential. Customization is part of the core commodity but it is a superficial process. It is still however obviously eligible for deduction from taxation.

In the Isbe Consultancy Services Ltd.[13] case, the assessee seeking deduction was a consultancy firm offering professional advice as service to a manufacturer not related to the Export Economic Zone itself. Hence in that area only advice for customization was produced as an exported service, and no actual production. This was still considered manufacture of software though. Thus any one of many assembly stages of production can be carried out and still be individually eligible for deduction.

It must be noted that in international customization services a heavier form of customization known as country customization is practiced wherein softwares are heavily modified from their generic produced state to suit the legal requirements of various nations. That the smaller form of customization, namely customer customization, is not a part of manufacturing[14], has not been disputed.

So far we see that Indian judiciary seemingly construes a lot of harmony in the process of interpreting tax provisions, but a thorough read of their verdicts reveal that a lot of decisions are really based on authorities related to the Institute of Chartered Accountants of India, and other such authorities of taxation law. If we consider thus that the intention of legislators and beaurocrats are being satisfied, we derive that India has an exceedingly friendly tax policy towards these Special Economic Zones, Software Technology Parks, Free Trade Zones and the likes.

The same policy the author understands has been confirmed by the apex court[15].

Further, The Central Board of Direct Taxes has notified a broad range of specific services eligible for deduction, which revolve around business processing, back-office operations, multimedia in business, designs, networks, catalogs, accounting and customer care.

Another thing is that formation of a business organization from the split of a previous organization does not entail that the date of such split can be used to fit into the various time frames mentioned in the provision[16]. Further, the industry itself must have been formed from scratch and not from a division or split. However, it was held in American Express India Pvt. Ltd. vs. CIT[17] that starting of a new unit by an existing business cannot be considered as formation through such ‘split’, but rather it is a fresh start eligible for these deductions.

There are also some other more stringent aspects to this provision, such as that the production must be carried out by new machinery entirely for the new business and not source assets in a manner so as to recycle older businesses and their own assets. This rule ensures quality in the foreign trade sector itself.

The author lauds this legal system and submits that while the rule itself ensures that an industry does not seek to get deductions through multiple provisions for the same business and that people do not hide behind corporate veils, the precedent laid down also ensures that businesses themselves can constantly expand and be motivated to attempt foreign trade.

Also, there is a time limit within which sale proceeds must flow into India, from these exports. These are set and may be extended as well by the Reserve Bank of India or even Foreign Exchange Management Act authorities.

The value of the deduction is the quotient of the product of total profits and export turnover, and the total turnover.

Similar procedural formalities to those mentioned above also exist for the filing of returns and deduction should be claimed in time too. This is not negotiable and no appeal exists for extension[18].

However, there is also a portion of the law regarding income tax deductions for exporting industries on free trade zones/software or engineering technology parks/special economic zones, which the author disagrees with. The purpose of these deductions as mentioned above is to promote foreign trade and the consequential cultural globalization, employment and infrastructure development. Apart from this, though, the Union also allows deduction on income from the foreign exchange fluctuations gains itself. This has been established in CIT vs. Gem Plus Jewellery India Ltd[19]. This is unfavorable because in terms of national policy it makes no sense to encourage an entire nationwide of entrepreneurs to earn through foreign exchange fluctuations alone. These fluctuations are not compliments to economic stability either, considering that India is among the underdeveloped nations in the first place. As is dealt with in greater detail in the next chapter, it is not healthy to be thoroughly reliant on foreign trade alone, and it is the peak of a hyper-liberalized mentality to allow deductions in tax for merely earning through foreign exchange fluctuations. While exports have to be promoted international trade itself must be second priority and self-consistency must be more incentivized by the State.

The mentality of only promoting exports but not considering the status of foreign trader itself as a privilege is not only that of the author’s. It is funny to note that the state has also held a similar attitude when dealing with interest earned on fixed deposits from earnings on these international trade zone exports, in the case law Renaissance Jewellery P. Ltd. vs. ITO[20].

This entire set of deductions is allowed only for ten years on establishment. It is submitted that there are scenarios where such a rule can be helpful to encourage new talent and fresh businesses which by extension increases employment, because new businesses will have an edge over older ones in the same field.

- LAW APPLICABLE TO INDUSTRIES ESTABLISHED AFTER 2005

The Special Economic Zones Act came out in 2005. This subchapter deals with the income tax act deductions[21] applicable to the industries covered therein. It is governed by section 10AA.

These deductions are only in instances where all plants and machineries are newly purchased and unused. There are however procedural regulations allowing exceptions.

The production herein is defined as something that brings about a product with distinctive name/character. Thus it could be any process from refrigeration to cutting.

Much of the same rules under S.10A are simply repeated herein for Special Economic Zones as under the 2005 Act.

Further specific rules are incorporated based on the case laws studied above; for instance, to discern whether an enterprise claimed as an SEZ is a split up part of an earlier enterprise or a new unit set up there exist tests such as that the strength of the ‘unit’ should not exceed 50 per cent of the total strength of the parent base, and that the additional number of employees employed in the past year throughout all branches of the main concern should be at least fifty percent of the strength of the ‘unit’.

Further, Special Economic Zones established under this statute do not have uniform deductions but rather diminishing throughout the years. At the same time, half the period of eligibility for deductions has a hundred percent concession on tax. This shows that the state has acted in accordance with the diminishing specialty of foreign trade in today’s India, as in it is less deserving of concessions, while at the same time heavily encouraging export trade.

Also, given the circumstances, a unit opened on the same premises of the previous one, by an undertaking, may be considered a new unit, given the circumstances. Also, relocating a unit from place to place also does not lose any deductions or concessions. The provision[22] takes care that a businessperson is free to diversify, branch out or optimize in any way his or her production without being concerned about losing perks.

CONCLUDING OPINIONS:

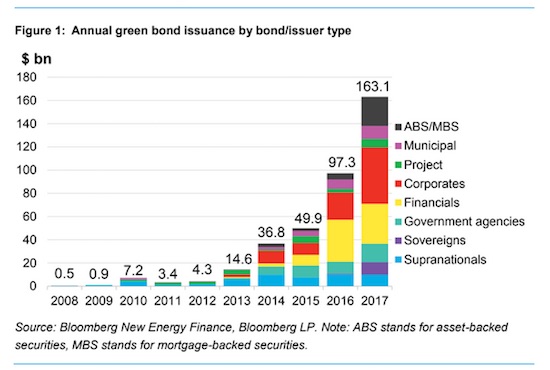

It is undisputed that the Indian economy has largely developed after liberalization, and any shortcomings remaining are not direct consequences of the same[23]. Despite a global recession, the growth of the economy is largely steady, with 7 to 9 percent every year, and has multiplied roughly 22.16 times from its size 26 years ago[24]. It is currently the fastest growing[25].

Especially with regards to export of software, Rajiv Gandhi was the visionary behind the development of the Information Technology Industry in India[26]. Today the contribution of Information Technology to the GDP has risen over 7 percent[27].

Thus there can be no doubt that foreign exchange is incredibly useful to India and that it must be promoted by making foreign investments and exports. However, Indian tax model is in general progressive[28]. This means that the rate of taxation increases with the increase in wealth and incomes.

At the same time, self-sufficiency is one of the most important requirements for a developing nation[29]. Most international institutions are open about their preference towards the aims and goals of the developed nations, and trade relations are bound to benefit these nations more[30]. In fact, it is no secret that Multinational Corporations generally look for cheap physical and human resources[31] to set up shop. With a liberalized economy there are many advantages, but there are disadvantages as well. A heavy reliance on an internationalized economy will make a heavy brunt when the international economy itself has problems[32]. Therefore self-sufficiency in the manner envisaged for the Green revolution must be extended to other sectors too.

REFERENCES:

STATUTES:

- Income Tax Act 1961

- Special Economic Zones Act 2005

RULES:

- CISA review Manual, Information Systems Audit and Control Association of USA, 2004

- Modules IV-VII, Information System Audit Reference Book, Institute of Chartered Accountants of India

CASE LAWS:

- American Express (India) Pvt. Ltd. v. CIT [2012] 150 TTJ (Delhi) 316

- Bajaj Tempo Ltd. vs. CIT (1992) 196 ITR 188 (SC)

- CIT v. Ajay Printery (P) Ltd. (1965) 58 ITR 811 (Guj) (4)

- CIT v. Gem Plus jewellery India Ltd/ [2010] 194 Taxman 192 (Bom)

- CIT v. IBM World Trade Corporation(1981) 130 ITR 739 (Bom)

- CIT v. N.C. Budhaiaja and Co. and Anr. (1993) 204 ITR 412 (SC)

- CIT v. Peerless Consultancy & Services (P) Ltd. (2001) 248 ITR 178 (SC) (5)

- CIT v. Shaw Wallace & Co. Ltd. (1993) 201 ITR 17 (Cal) (6)

- CIT v. Sterling Foods (Goa) (1995) 213 ITR 851 (Bom) (2)

- CIT v. Tata Locomotive & Engg. Co. Ltd. (1968) 68 ITR 325 (Bom) (3)

- CIT vs. Gem India Mfg. Co. (2001) 249 ITR 307 (SC)

- Direction Software Solutions vs. ITO [2008] 116 TTJ (Mum.) 841

- Isbe Consultancy Services Ltd. vs. Deputy Commissioner of Income Tax 2004 88 ITD 134 Mum, (2004) 83 TTJ Mum 597

- Renaissance Jewellery P. Ltd. vs. ITO [2005] 4 SOT 50 (Mum.)

- Saffire Garments vs. ITO [2013] 14 ITD 6 (Rajkot) (SB)

BOOKS:

- Eun, Cheol S; Resnick, Bruce G: International Financial Management, (6th edition 2013), Beijing Chengxin Weiye Printing Inc.

- Singhania and Snghania-TAXMANN’s direct taxes law and practice-53rd edition 2014

ARTICLES:

- 25 years of Liberalization: A Glimpse of India’s growth in 14 charts retrieved on 16th September 2017 at http://www.firstpost.com/business/25-years-of-liberalisation-a-glimpse-of-indias-growth-in-14-charts-2877654.html

- Elkan Turn-Progressive Income Taxes-Columbia Law Review, Vol. 12 No. 5, May 1912

- GDP: At 7.6%, India’s growth points to fastest growing large economy-retrieved on 16th September 2017 at http://indianexpress.com/article/business/economy/gdp-7-9-percent-its-official-india-is-now-the-fastest-growing-economy-in-the-world/

- K.Sachdeva, Impact of World’s Economic Recession on India’s Growth Perspective – Theories and Facts, Vol. V Issue 3, Journal of Global Economy 2009.

- Recognize Rajiv Gandhi’s True Legacy retrieved on 16th September 2017 at http://indiatoday.intoday.in/story/recognise-rajiv-gandhis-true-legacy/1/213960.html

- Saikia, Dilip. (2012). Indian Economy after Liberalization: Performance and Challenges. First edition, SSDN Publishers.

- The Green Revolution-retrieved on 17th September from the US Library of Congress

- The IMF and the World Bank: Puppets of the Neo-liberal Onslaught retrieved on 17th September 2017 from www.mit.edu

- nasscom.in

[1] S.2(n), Special Economic Zones Act 2005

[2] S2(za), Special Economic Zones Act 2005

[3] S.5, Special Economic Zones Act 2005

[4] S.10A, Income Tax Act 1961

[5] P.97 Singhania and Snghania-TAXMANN’s direct taxes law and practice-53rd edition 2014

[6] CIT v. N.C. Budhaiaja and Co. and Anr. (1993) 204 ITR 412 (SC)

[7] S.10A, 10B, Income Tax Act 1961

[8] Direction Software Solutions vs. ITO [2008] 116 TTJ (Mum.) 841

[9] Ibid.

[10] Modules IV-VII, Information System Audit Reference Book, Institute of Chartered Accountants of India

[11] CISA review Manual, Information Systems Audit and Control Association of USA, 2004

[12] Isbe Consultancy Services Ltd. vs. Deputy Commissioner of Income Tax 2004 88 ITD 134 Mum, (2004) 83 TTJ Mum 597; CIT v. Sterling Foods (Goa) (1995) 213 ITR 851 (Bom) (2) CIT v. Tata Locomotive & Engg. Co. Ltd. (1968) 68 ITR 325 (Bom) (3) CIT v. Ajay Printery (P) Ltd. (1965) 58 ITR 811 (Guj) (4) CIT v. Peerless Consultancy & Services (P) Ltd. (2001) 248 ITR 178 (SC) (5) CIT v. Shaw Wallace & Co. Ltd. (1993) 201 ITR 17 (Cal) (6) CIT v. IBM World Trade Corporation (1981) 130 ITR 739 (Bom)

[13] Supra Note 11

[14] CIT vs. Gem India Mfg. Co. (2001) 249 ITR 307 (SC)

[15] Bajaj Tempo Ltd. vs. CIT (1992) 196 ITR 188 (SC)

[16] Supra Note 4

[17] American Express (India) Pvt. Ltd. v. CIT [2012] 150 TTJ (Delhi) 316

[18] Saffire Garments vs. ITO [2013] 14 ITD 6 (Rajkot) (SB)

[19] CIT v. Gem Plus jewellery India Ltd/ [2010] 194 Taxman 192 (Bom)

[20] Renaissance Jewellery P. Ltd. vs. ITO [2005] 4 SOT 50 (Mum.)

[21] S.10AA, Income Tax Act 1961

[22] Ibid.

[23] Saikia, Dilip. (2012). Indian Economy after Liberalization: Performance and Challenges. First edition, SSDN Publishers.

[24] 25 years of Liberalization: A Glimpse of India’s growth in 14 charts retrieved on 16th September 2017 at http://www.firstpost.com/business/25-years-of-liberalisation-a-glimpse-of-indias-growth-in-14-charts-2877654.html

[25] GDP: At 7.6%, India’s growth points to fastest growing large economy-retrieved on 16th September 2017 at http://indianexpress.com/article/business/economy/gdp-7-9-percent-its-official-india-is-now-the-fastest-growing-economy-in-the-world/

[26] Recognize Rajiv Gandhi’s True Legacy retrieved on 16th September 2017 at http://indiatoday.intoday.in/story/recognise-rajiv-gandhis-true-legacy/1/213960.html

[27] www.nasscom.in

[28] Elkan Turn-Progressive Income Taxes-Columbia Law Review, Vol. 12 No. 5, May 1912

[29] The Green Revolution-retrieved on 17th September from the US Library of Congress

[30] The IMF and the World Bank: Puppets of the Neo-liberal Onslaught retrieved on 17th September 2017 from www.mit.edu

[31] Eun, Cheol S; Resnick, Bruce G: International Financial Management, (6th edition 2013), Beijing Chengxin Weiye Printing Inc.

[32] J.K.Sachdeva, Impact of World’s Economic Recession on India’s Growth Perspective – Theories and Facts, Vol. V Issue 3, Journal of Global Economy 2009.