Latest Articles

Doctrine of lifting of corporate veil

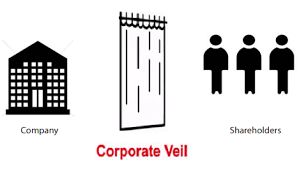

A company as an entity has many distinct features which together make it a unique organization and one of the most important feature of the company is that it has a seperate legal entity.Seperate legal entity means the company is distinct and different from its members in law. It has its own seal and its own name, its assets and liabilities are separate and distinct from those of its members. It is capable of owning property, incurring debt, and borrowing money, employing people, having a bank account, entering into contracts and suing and being sued separately.No member of a comapny can be made help liable for the acts of the company and the comapany also can not be held liable for the illegal acts of the members.

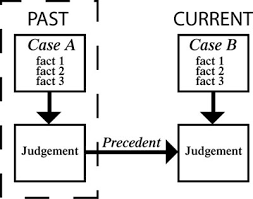

There is a most important doctrine under the corporate law that is Piercing the corporate veil or lifting the corporate veil.According to this doctrine the rights and liabilities of the members and the company is consedered to be the same they both are not treated as a seperate legal entity.Company enjoys a separate position from that of position of it’s owners. It is artificial but yet a person in eyes of law. Problems arise when this position of the company is misused.Thus, wherever the company is employed for the purpose of committing illegality or for defrauding others, Courts have authority to ignore the corporate character and look at the reality behind the corporate veil in order to ensure justice is served.This approch is know as the Piercing the corporate veil or lifting the corporate veil.

The doctine of Piercing the corporate veil or lifting the corporate veil was identified and well established in the case of Salomon v. Salomon & Co. Ltd in which the court held that the company had been validly constituted, since the Act only required seven members holding at least one share each and that Salomon is separate from Salomon & Co. Ltd.

Some of the scenarios in which corporate veil can be lifted

1) To determine the real character of the company

To determine whether the character of the company is of enemy or of friend the court can adopt the doctine of Piercing the corporate veil or lifting the corporate veil.

2) To protect revenue or invasion of tax

In matters concerning evasion or circumvention of taxes, duties, etc.the Court might disregard the corporate entity.Court to understand the real owner of the income of the company and make the said person liable for legitimate taxes can disregard the principle of seperate legal entitiy.

3) Prevention of fraud

In cases where a company is formed for some illegal or improper purposes like defeating the law, the Courts might decide to lift or pierce the corporate veil.

4) Froming subsidiaries to act as an agent

Where any company is formed to act as an agent or trustee of its members or another company the court in such cases can disregard the principle of seperate legal entity.

5) Avoding legal obligation

Sometimes the another company is created to act as a trustee or agent so that the legal obligation can be avoided by the members in such cases again the court can disregard the principle of seperate legal entity.

6) Public Interest

If the court is in the opinion that in the interst of the company it is important to lift the coroprate veil the court can diregard the principle of seperate legl entity in such cases.