Latest Articles

Concept of Insider Trading under Investment Law

INSIDER TRADING – AN OVERVIEW

Insider trading is an act of trading, directly or indirectly, within the securities of a publicly listed company by any person, who may or might not be managing the affairs of such company, based on certain information, not available to the general public at large, which will influence the market price of the securities of such company.

The United States of America was the 1st country to formally enact a legislation to regulate insider trading. India was not late in recognizing the detrimental impact inflicted by insider trading upon the rights of the public shareholders, corporate governance in India and the financial markets overall. The first step toward senacting a regulation of insider trading in India was taken in 1948 by constituting a committee under the chairmanship of Mr. P.J. Thomas to evaluate restrictions that can be imposed upon such trade practices. As on date, Securities and Exchange Board of India, the market watchdog regulates insider trading through the SEBI Act, 1992 and the SEBI (Prohibition of Insider Trading) Regulations, 1992 (Insider Trading Regulations) issued under the SEBI Act.

It operates as a malpractice wherein trade of a company's securities is undertaken by people who by virtue of their position have access to price sensitive information which can prove crucial for making investment decisions. Insider trading appears biased and discriminatory to investors as insiders have additional price sensitive information with them and they may use it to obtain profits while the late reception of information makes investors lagging behind and suffer loss or not gain the deserved profits. The need for regulating fair insider trading is to protect general investors and maintain public confidence in Stock Exchange operations and also to protect interest and reputation of the company.

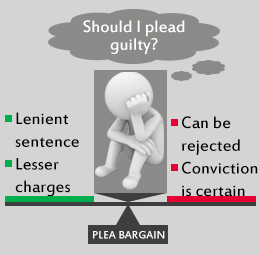

Insider Trading is the trading of securities of a company by an Insider using company's non-p ublic, price sensitive information while causing losses to the company or profit to oneself.The Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations 1992, doesn't directly define the term Insider Trading. But it defines the term 'Insider' and 'Price Sensitive Information'. Price Sensitive Information means any information, which relates directly or indirectly to a corporation and which if published, is likely to materially affect the worth or value of securities of the company. Regulation 4 of the Insider Trading Regulations stipulates that any insider who deals in securities in contravention of the provisions of regulation 3 or 3A shall be guilty of insider trading. Therefore, in India, the test of whether any person is guilty of insider trading or not is decided by whether that person has breached Regulations 3 or 4 of the Insider Trading Regulations.

SEBI may impose a maximum penalty of not more than Rs. 25 Crores or 3 times the amount of profit made out of Insider Trading whichever is higher as mentioned under section 15G of SEBI Act 1992.. SEBI may also initiate criminal prosecution. Though there is absolutely no restriction on insiders for trading in securities of the company if they do not hold any price sensitive information that the public is not already aware of.

India has put great efforts in the enactment of Insider Trading Prohibiting Law. To bring it at par with international standards of Insider Trading Laws, SEBI have modified the laws on Insider Trading under the chairmanship of Justice N. K. Sodhi and drafted the "Prohibition of trading Regulations, 2015." The new trading Regulations has caused several changes by amending definitions of varied concepts such as Connected person, price sensitive information etc.These regulations strenghten the legal and enforcement framework, align Indian regime with international practices, provide clarity with reference to the definitions and provisions, and facilitate legitimate business transactions. The New Insider Trader Regulations, 2015 is far more appreciated because it deals with a good range of problems associated with insider trading and also has severely reduced loopholes.

Though there is still a long way to be traveled for a strict compliance dealing it. In other developed countries, there's strong legislation regarding the trading but in India, though there's legislation under SEBI Act, 1992 but the speed of investigations is very low due to many factors and therefore the government is required to look into the matter strictly and pass more strong legislation to curb the illegal insider trading practices