Latest Articles

CORPORATE GOVERNANCE

Corporate governance is concerned with holding the balance between economic and social goals and objectives of the corporation and between individual and communal goals. The governance framework is formed to encourage the efficient use of resources and equally to require accountability for the administration of those resources. The main aim is to attract as nearly as possible the interests of individuals, corporations and society.

The Companies Act 2013 is about improving corporate governance which revolves around the Board of Directors, Senior Management of the Company, their roles, responsibility and accountability, Rights and equitable treatment of stakeholders, prompt disclosures, transparency, the legal and regulatory compliances and appropriate risk management measures to protect and enhance interest of all stakeholders.

This definition of corporate governance highlights the importance of corporate governance in providing the incentives and performance measures to achieve business success, and secondly in providing the accountability and transparency to ensure the equitable distribution of the resulting wealth. Finally the significance of corporate governance in enhancing the stability and equity of society recognises a more productive and dynamic role for business. Instead of corporate governance and regulation being inherently restrictive, they can be a means of enabling corporations to achieve the highest goals of corporate achievement.

Corporate governance lies at the heart of the way every corporation or businesses run. Governance relates to how the board is constituted in a corporation or business and how it performs its role for achieving the goals. It encompasses issues of board composition and structure, the board’s remit and how it carried out and the framework of the board’s accountability to its stakeholders. It also concerns with how the board delegates the authorities to manage the business throughout the organization.

The word Corporate Governance represents the value framework, the ethical framework and the moral framework under which business decisions are taken or in simpler words when investment takes place across national borders, the investors want to be sure that not only their capitals are handled effectively and adds to the creation of wealth, but the business decisions are also taken in a manner which is not illegal or does not involve any moral hazards or is harmful to the society.

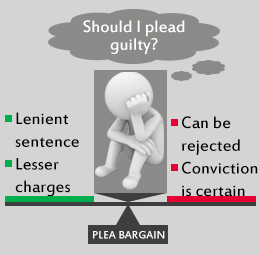

The primary objective of a corporation is to increase shareholder value. Successful corporations must operate within society; to that end, they must maintain the values and norms of the society in which they operate. Volkswagen has been one of the unfortunate recipients of a great deal of press time lately. In case you missed the details, it recently came to light that Volkswagen knowingly deceived the United States Environmental Protection Agency (EPA) with respect to nitrous oxide (NOx) engine emission for their TDI engines. The company programmed the vehicles to favourably behave differently during EPA testing. The engines actually exceeded emission test levels during every day use by roughly 40 fold. The number of affected vehicles is not small – approximately 11 million cars worldwide.

While the old adage goes that there is no such thing as bad publicity, the company’s publicly traded market share losses topped €14 billion during the fallout, suggesting otherwise.Oversight outlined in the act includes objective mandates such as auditor independence, enhanced disclosure and criminal fraud accountability, as well as subjective mandates like corporate responsibility. Regulation falls on the Securities and Exchange Commission. It is easy to argue that some corporations make money through dealings in conflict with what is socially acceptable to the majority, but the theoretical purpose is the legal imposition of accountability.