Latest Articles

What is a Green Bond?

Green bonds are fast becoming one of the most interesting aspects of financial market innovation with increasing interests, specially amongst investors in advanced and emerging economies alike.

What exactly is a green bond? A green bond represents an alternative investment opportunity for participants in financial markets. They are fixed interest loans, typically with a long dated maturity (10 to 20 years or more) and they are designed to raise debt finance to help fund climate-friendly investment. It is crucial to link green bonds to meet the 17 Sustainable Development Goals. They have been around for just over a decade, first introduced by the European Investment Bank in 2007 to finance its climate-related projects which was listed on the Luxembourg Stock Exchange. The term was first coined by the World Bank in 2008 as there was an increase in interest activities from organizations, such as pension funds, sovereign wealth funds including the biggest one in Norway and insurance companies hoping to finance the issuance of green bonds.

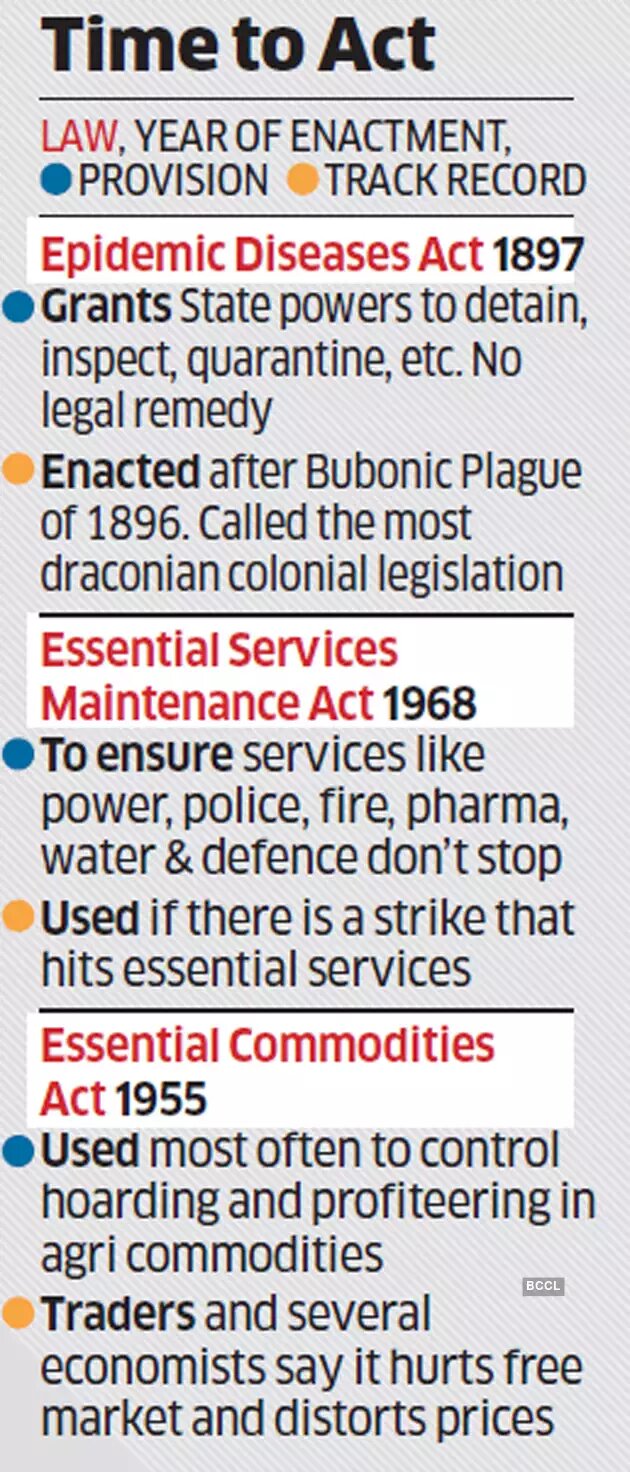

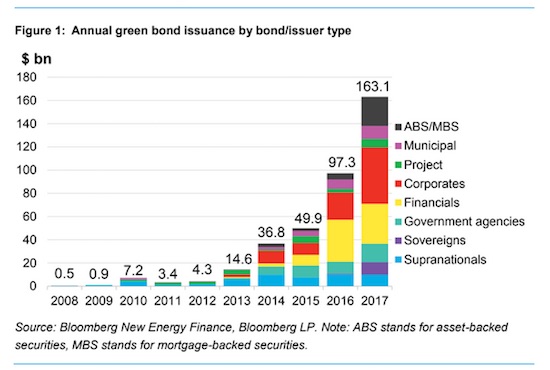

The green bond market has clearly grown as the graph shows. It is estimated that the total stock of sustainable debts also known as a green bond or climate-smart bond is now over USD1 Trillion but compared to financial markets as whole, it remains a drop in the ocean and represent less than 1% of the size of the global bond market issued.

Green bonds fund businesses and projects that are environmentally friendly. Some examples for the same includes bonds to fund more fuel-efficient container ships and tankers in the global logistics industry, investment projects in off-shore wind turbines and solar farms - particularly in developing counties, telecom firms issuing bonds, giving green credentials to finance and upgrade copper cabling with carbon fibre, Dutch Government raising green bonds to help fund improved flood defence systems, Seychelle- an archipelago of 15 islands- issued a blue bond to support sustainable marine and fisheries projects as it is highly exposed to climate change. Kenya is considering listing a sovereign green bond as part of their strategy for sustainable development taking an example from the Netherlands- the Dutch Government who issued one the largest green bonds : 5.98 billion Euros towards low-carbon development and sustainable water management. It is a part of their infrastructure plan to tackle climate change.

Green bonds has an intuitive appeal in terms of a long-term responsible investment in sustainable projects but does contain disadvantages to it. There is a risk of “greenwashing”. This is where firms raise money notionally trying to establish a climate smart credentials but in fact make misleading claims for other purposes including paying off debts. Green bonds typically have a higher transaction cost which includes regulatory costs of how the money is being used. Although green bonds can help fund sustainable investment, it is important and evaluate to not ignore other policy interventions such as fiscal policies via carbon taxes, carbon trading renewable subsidies and tougher or more stringent environmental regulations. Further, green bonds might have grown expeditiously but still only represent 1% of the global bond market.

Green bond finance is relatively a new concept but the fast growth of responsible investing is to look out for. The key question to focus on is whether green bonds help accelerate the transition to a low carbon economy and help mitigate the risks from the climate crisis?