Latest Articles

Business Laws in India

Business Laws in India

Many business laws in India existed preceding the country’s independence in 1947. Partnership firms in India are covered under The Partnership Act of 1932. The Banking Regulation Act of 1949 continues to manage private banking companies and manage banks in India. In 2012, it was amended by the Banking Law (Amendments) Act. Under these amendments, the reserve bank of India (RBI) was given power to limit voting rights and shares acquisition during a bank. The RBI established the Depositor Education and Awareness Fund. Banks are now ready to issue both equity and preferred stock under RBI guidelines.

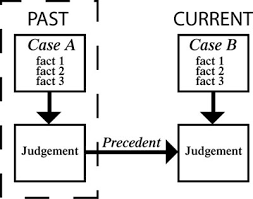

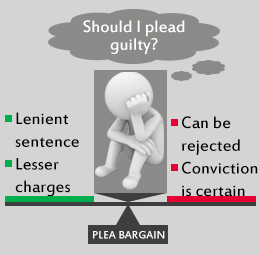

While India is usually criticized for complex regulations, it's important to keep in mind that in some cases, these laws are simpler than those of the U.S. Moreover, most regulations are consistent across the country. Attorneys in India can practice in any state. Filing lawsuits is seldom productive in most commercial disputes since proceedings can drag on for many years and collection can take even longer. For large deals, binding third-country arbitration is often the simplest thanks to resolving disputes.

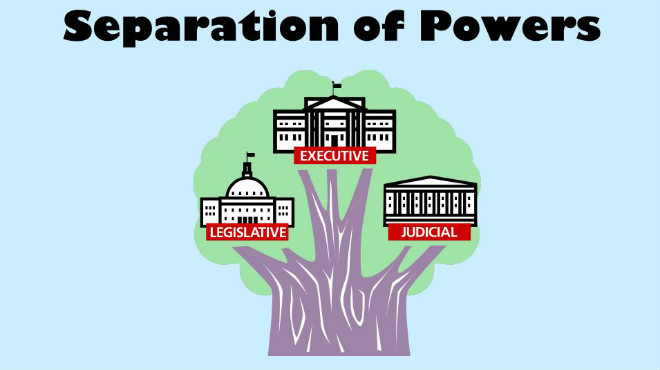

Regulations for both businesses and investors are passed and amended by The Parliament of India. In addition to provisions from the companies Act of 1956, the companies Act of 2013 features provisions regarding mergers and acquisitions, boardroom decision-making, related party transactions, corporate social responsibility, and shareholding.

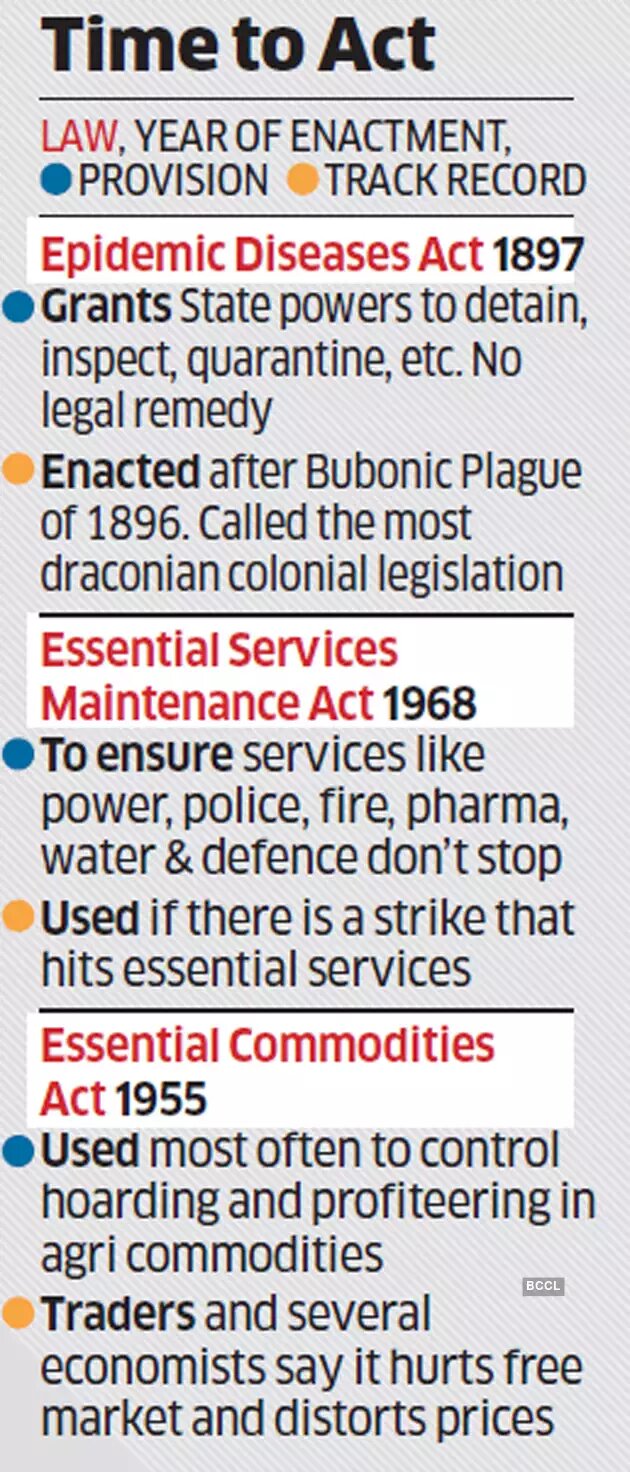

As a member of the International Labor Organization, India offers protections for workers . These include the Payment of Wages Act of 1936, the economic Employment Act of 1946, the industrial Disputes Act of 1947, the Payment of Bonus Act of 1965, and the 1972 Payment of Gratuity Act. Protections include annual bonuses of 8.33% and separation fees of about 15 days per annum of employment. Other labor laws like the Building and Other Construction Workers Acts of 1996 and therefore the Workmen’s Compensation Act of 1923 (amended in 2000) are in effect.

Business laws in India include consumer protection. The Consumer Protection Act, 1986 mandates Consumer Dispute Redressal Forums at local and national levels. Older laws, like the Standards of Weights & Measures Act of 1956, ensure fair competition within the market and free flow of correct information from providers of products and services to consumers.

Due to the expansion of trade, the Indian government passed the Foreign Trade (Development and Regulation) Act of 1992 to facilitate imports and augment exports. The latest EXIM Policy, referred to as the Foreign trade policy, was issued for April 2015 to March 2020. The Served from India Scheme was replaced by The Service Exports from India Scheme (SEIS). The SEIS extends the duty-exempted script to Indian service providers and provides notified services during a specified mode outside the country. Under the Export Promotion Capital Goods Scheme, the export obligation requires sixfold the duty saved on imported capital goods; within the case of local sourcing of capital goods, the export obligation is reduced by 25%. Beyond goods and services, the exchange Management Act of 1999 regulates exchange transactions including investments abroad.

As a founding member of the Planet Trade Organization in 1995, India has updated business laws regarding copyrights, patents, and trademarks to satisfy the Agreement on Trade Related Aspects of Intellectual Property Rights. Indian companies and therefore the federal honor global IP rights. However, because music copyrights are different in India, both Indian and Western IP owners within the industry have suffered because of digital piracy. In 2013, India’s Supreme Court denied Novartis an extension to update its antineoplastic Glivec because of “evergreening” charges. The Information Technology Act of 2000 in 2008 was amended to supply explicit legal recognition of electronic transactions.