Latest Articles

New Consumer Protection Bill 2018 Will Entail More Punishment

Introduction

Coming straight to the crux of the matter, let me begin first and foremost pointing out that a new Consumer Protection Bill has been tabled in the Lok Sabha on January 5, 2018. This was presented on the last day of the winter session of Parliament. The Union Minister for Consumer Affairs – Ram Vilas Paswan introduced the new Consumer Protection Bill, 2018 in the Lok Sabha.

Replacing Old Act By New

Needless to say, if all goes well, the Bill will certainly become an Act sooner than later. It will replace the Consumer Protection Act, 1986. The Consumer Protection Bill, 2018 is more wider in its ambit as compared to the Act of 1986.

Object Of New Bill

This new Consumer Protection Bill, 2018 seeks to enforce stringent provisions in order to protect consumers by regulating online sales, providing for higher manufacturer liabilities, even restricting tall claims, including some made through celebrity brand endorsers. It thus legislates on at least three new areas vis-à-vis the older law. It seeks to set up an authority to safeguard consumer rights in view of current challenges posed by e-commerce, direct selling, tele-marketing and misleading ads, among others.

Wider Scope

As it turns out, the new law will apply to all goods and services, including sale/construction of homes/flats and telecom services. It brings within its fold all forms of selling – offline/online sales, teleshopping, direct selling and multi-level marketing. In other words, this new law envisages wider application covering all goods, services and selling.

Truth be told, while the earlier law did cover unfair trade practices, the current one certainly seeks to make it more comprehensive. It adds practices such as failure to issue a bill or a receipt, refusal to accept a good returned or refusal to discontinue service within 30 days (if it is so stipulated and requested by the consumer) and disclosure of personal information given in confidence, to the list of unfair practices. It also defines unfair contracts. Issues such as excessive security deposit requirements, penalty for breach of contract which is disproportionate to the loss incurred and refusal to accept early repayment of debt on payment of applicable penalty will now fall squarely under its ambit.

Product Liability

It must be reiterated here that the highlight of the new law is the inclusion of the product liability action. Thus, we see that when any one of us suffer any harm due to a defect in a product made by the manufacturer, serviced by a service provider or sold by a product seller, earlier there was no fixed liability but now we have a right to claim compensation once the 2018 Bill becomes a law. The 2018 Bill further lays down the appropriate circumstances under which the manufacturer, service provider and seller will be held liable.

Conditions For Liability

As for instance, we see now that a product manufacturer will be liable to compensate for harm caused to the consumer under any one of the following conditions. Those conditions are as follows: -

- The product contains a manufacturing defect;

- It is defective in design;

- There is a deviation from the manufacturing specifications;

- It does not conform to the express warranty; and

- It does not contain adequate instructions for correct usage.

Regulator On Anvil

It is well known that to promote and protect the consumer rights, the Consumer Protection Councils at the district, state and national levels are prescribed under the current law. But its biggest handicap is that it is only an advisory body and hence does not have powers of enforcement. To overcome this handicap, this new Bill brings in a regulator for consumer affairs, much like the Securities and Exchange Board of India (SEBI) for the markets or the Insurance Regulatory and Development Authority of India (IRDAI) for insurers.

To be called the Consumer Protection Authority, the new regulator will be a central authority with offices at the regional level. The new Consumer Protection Authority will have power to monitor and enforce the new regulatory regime that the Bill seeks to implement. The Bill says very specifically that, “This fills an institutional void in the regulatory regime extant. Currently, the task of prevention of or acting against unfair trade practices is not vested in any authority.”

To be sure, this Authority will have the requisite powers to inquire and investigate into complaints and initiate prosecution. It will also be empowered to issue safety notices/pass orders in relation to matters such as recall of goods, reimbursements of the amount paid by consumers, misleading advertisements and unfair trade practices/contracts. This would ensure that consumer protection law is not blatantly violated with impunity as this Consumer Protection Authority would check this and act as a powerful deterrent.

Consumer Disputes Redressal Commission (CDRC)

It must be added here that the CDRCs will be set up at the district, state and national levels. A consumer can file a complaint with CDRCs in relation to:

(i) unfair or restrictive trade practices;

(ii) defective goods or services;

(iii) overcharging or deceptive charging; and

(iv) the offering of goods or services for sale which may be hazardous to life and safety.

Complaints against an unfair contract can be filed with only the State and National CDRCs. Appeals from a District CDRC will be heard by the State CDRC. Appeals from the State CDRC will be heard by the National CDRC. The final appeal will lie before the Supreme Court.

Jurisdiction Of CDRCs

To tell the truth, the District CDRC will entertain complaints where value of goods and services does not exceed Rs one crore. The State CDRC will entertain complaints when the value is more than Rs one crore but does not exceed Rs 10 crore. Finally, the complaints with value of foods and services over Rs 10 crore will be entertained by the National CDRC.

Punishment For Non-Compliance

To put things in perspective, the non-compliance of the order issued by the Consumer Protection Authority is punishable with am imprisonment of up to six months or a fine of up to Rs 20 lakh, or both. The Authority may also impose penalties with regard to the misleading advertisements, food adulteration and spurious goods. A penalty on the endorser of the misleading advertisement is suggested as well, which could put celebrities who endorse products that don’t live up to its claims, in the dock.

Punishment For False Claims In Advertisements

It must be highlighted here that misleading ads in various media touting exaggerated claims are very common and it is the consumers who have to suffer the most because of all this! Earlier there was a lack of clear legal provisions. But this new Consumer Bill of 2018 seeks to specify what constitutes false and unfulfilled claims.

This proposed new Consumer Protection Bill of 2018 imposes a jail term of up to two years and Rs 10 lakh as fine for manufacturers making false and misleading claims in advertisements. This could go up to five years in jail and Rs 50 lakh fine for repeat offenders. Very rightly so!

It is noteworthy that endorsers making such claims will face a penalty of up to Rs 10 lakh and a ban of a year from making endorsements. The repeated offenders would attract fines of up to Rs 50 lakh and a ban of up to three years. In fact the jail term for such repeated offenders must not be less than 5 years. But what an unbeatable irony that for repeated offenders no jail term is prescribed. This again must be set right!

Not just this, the repeated offenders must be barred permanently from making endorsements but this has not been done till now. It must be done before it becomes a law so that it acts as an adequate deterrent for repeated offenders. It is quite baffling that why this has not been done.

Defence For Endorsers

According to the Bill, the endorsers who can prove that they applied “due diligence” or appeared in an ad in “normal course of business” without knowledge of fraudulent intentions may use it as a “defence”. They have every right to stand immune from legal proceedings if they can prove that they had no fraudulent intentions of any kind while endorsing. No one can deny or dispute this! However, the Bill in the same vein also states that, “The burden of proof of such defence shall lie on the person raising such defence”.

Vulnerability Of Consumers

The Bill says that growth in e-commerce, international trade and newer services as well as innovative delivery chains have increased the choice before consumers but also made them vulnerable. So consumers have to be protected from becoming a vulnerable target who are liable to be exploited most easily!

Truly speaking, the Bill also states that, “The modern market place contains a plethora of products and services. The emergence of global supply chains, rise in international trade and the rapid development of e-commerce have led to new delivery systems for goods and services and have provided new options and opportunities for consumers. Equally, this has rendered the consumer vulnerable to new forms of unfair trade and unethical business practices.”

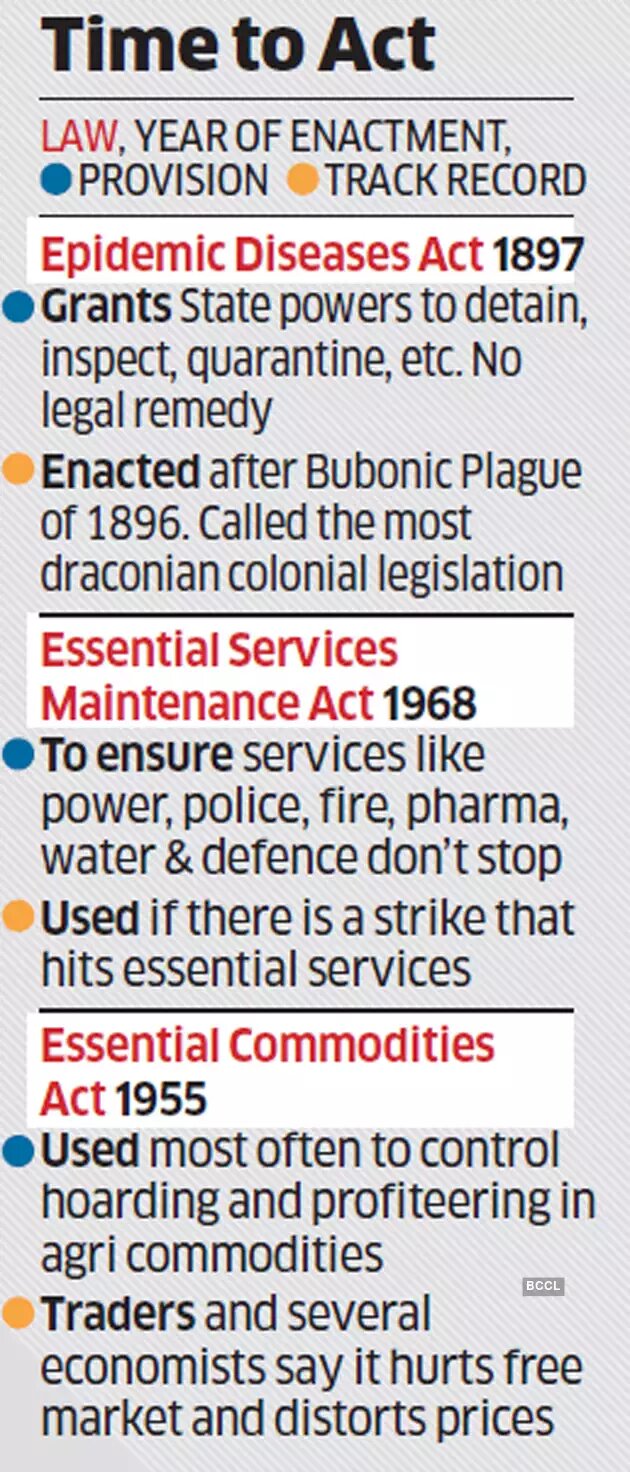

Curbing The Misuse Of Limitation

Unfair trade practices often take advantage of limitations in the current law. This must be plugged in the new Bill. If this is not done, the whole purpose of the new Bill will stand defeated. Pradeep Mehta of the CUTS International which is a consumer rights activist group points out that, “In an earlier era, issues like misleading ads and cheating were dealt with under the Monopolistic and Restrictive Trade Practices (MRTP) Act. But since the Competition Act, 2002, replaced the MRTP Act, it left out effective regulations to deal with unfair trade practices. This new Bill hopefully will address these shortcomings.” The Bill also provides for framing of rules subsequent to passage of the Bill for product recalls and on the responsibility of a firm for both safety and efficacy of its products.

Mediation Cells

Presently, a Redressal Commission operates at the district, state and national levels to adjudicate consumer disputes. The new law stipulates for an alternative dispute redressal mechanism if there is chance for a settlement agreeable to the parties to the dispute. The new Bill calls for setting up of mediation cells attached to the district, state and national commissions.

Conclusion

All said and done, this new Bill is certainly a marked improvement over the previous one. But still many more loopholes can and must be plugged before finally getting it assented to by the President. It certainly merits more deliberation in both Houses of Parliament. Only after a proper debate, discussion and deliberations by both Houses of Parliament should it be passed after going through it in detail so that no loophole is left out. This new Bill directly affects consumers in a huge way and so has to be taken most seriously so that consumers don’t suffer under any circumstances and have enough remedy to pursue when aggrieved which can be possible only if all their genuine concerns are taken into board and simultaneously also addressed before making it into a law by getting it passed in both Houses of Parliament!